What is a Crypto Wallet? All You Need to Know

The cryptocurrency markets are currently undergoing a turbulent period, leading investors to be primarily concerned about the safety of their funds.

Nobody wants their crypto assets to be adversely affected. One of the most effective methods to safeguard against the collapse of exchanges is using a cryptocurrency wallet. But what exactly is a crypto wallet?

The cryptocurrency world is experiencing one of its most challenging phases, triggered by the bankruptcy of FTX, one of the world’s largest exchanges. This event has led to a crisis that is not easily forgotten, with recent developments suggesting a potential domino effect in the industry.

In such a scenario, how can one protect their cryptocurrencies? We are about to discuss a method that can help you avoid the impact of cryptocurrency exchange crashes. If you’re concerned about safeguarding your crypto assets from failing exchanges, it’s crucial to take this information into consideration.

You can use a ‘wallet’ to protect your crypto assets!

Holding crypto assets on exchanges can sometimes be as risky as investing in obscure cryptocurrencies, because the exchange you use might be facing a crisis. Even if you have deposited actual cryptocurrencies, you might only see numbers on your screen that don’t reflect the reality.

The exchange could be financially struggling or even on the verge of bankruptcy. To prevent the loss of your crypto assets in such situations, it’s advisable to use either a digital (hot) wallet or a cold (offline) cryptocurrency wallet. This way, your assets remain secure in your wallet, irrespective of the exchange’s fate.

Crypto wallets are equipped with private and unique addresses. They allow you to store major cryptocurrencies like Bitcoin and Ethereum, as well as various altcoins. Additionally, these wallets enable you to transfer funds anywhere in the world, provided you have internet access.

You can use a ‘wallet’ to protect your crypto assets!

Holding crypto assets on exchanges can be as risky as investing in obscure cryptocurrencies, because the exchange you use might be experiencing a crisis. Even if you deposit real cryptocurrencies, you might only see numbers on a page that don’t reflect the actual situation.

The exchange could be facing financial difficulties or even nearing bankruptcy. At this juncture, it’s recommended to use either a digital (hot) wallet or a cold (offline) cryptocurrency wallet to safeguard your crypto assets. This ensures that, even if the exchange collapses, your assets will remain secure in your wallet.

Crypto wallets are equipped with private and unique addresses. They allow you to store major cryptocurrencies, such as Bitcoin and Ethereum, as well as a variety of altcoins. Additionally, with these wallets, you can transfer funds anywhere in the world, with only an internet connection needed.

Crypto wallets can also support different blockchain technologies. For instance, a wallet based on the Ethereum blockchain might accommodate many coins, but not necessarily those from a different blockchain. Therefore, opting for wallets that support multiple blockchains is advantageous for greater flexibility and utility.

What are hot and cold wallets? What is the difference?

Cryptocurrency wallets are categorized into two types: hot and cold. Hot wallets can be thought of as digital products, being software-based and typically developed and released by major cryptocurrency exchanges.

On the other hand, cold cryptocurrency wallets can be likened to flash drives equipped with specialized software. Cold wallets are generally safer than hot wallets because your crypto assets are stored exclusively within that flash memory, without any internet connection. However, hot wallets offer greater practicality, as they enable access to your cryptocurrency assets from anywhere with an internet connection.

So how do you become a crypto wallet owner?

Investors interested in acquiring a cold cryptocurrency wallet should order from companies specializing in manufacturing such hardware, with Ledger being one of the most popular brands in this field. The company, a long-standing player in the sector offering cold wallet solutions, has its products available on e-commerce platforms.

For hot wallets, the first step is to decide which crypto wallet, developed by a particular team, to use. Then, you should download the app provided by the development team onto a smartphone or a computer and follow the instructions to create a hot wallet. But which hot wallet should you choose?

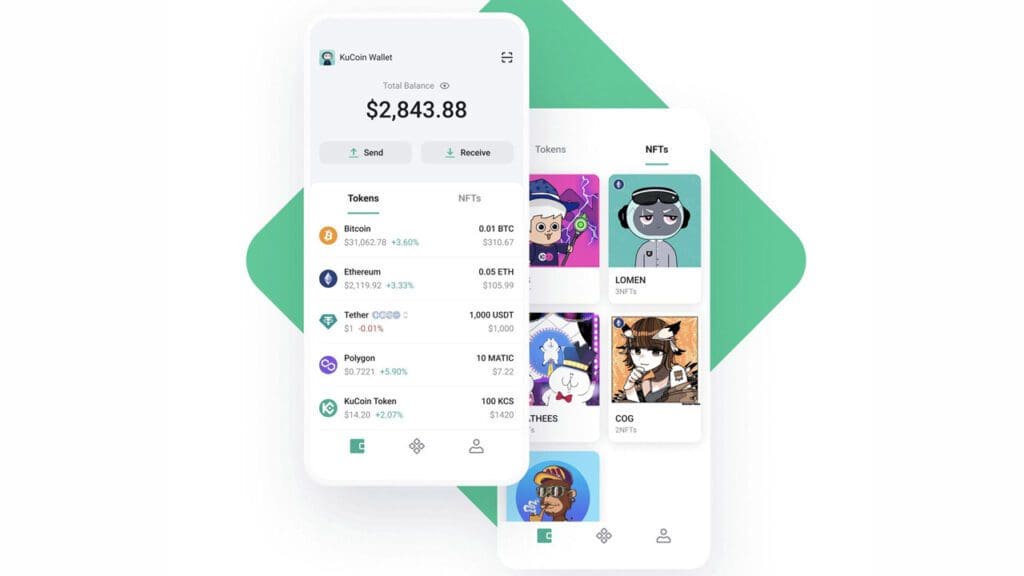

One of the reputable hot wallets is KuWallet, developed by KuCoin, the world’s fifth-largest cryptocurrency exchange by market volume. KuWallet, which supports a variety of assets including USDT, BNB, SOL, BTC, and ETH, was launched to cater to the needs of users transacting in cryptocurrencies like DOGEUSDT. Besides storing these coins, investors using KuWallet can also transfer them to other users and exchanges.

You may also like this content

- New Malware Targets and Empties Crypto Wallets Installed on Browsers

- BTC is Now an Official Asset Like Gold and Silver!

- Nigeria Sues Binance for $81.5 Billion: Here’s Why

Follow us on TWITTER (X) and be instantly informed about the latest developments…