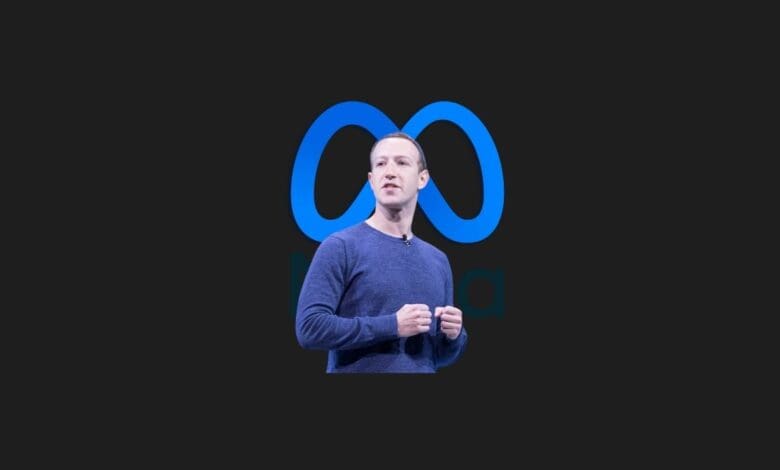

Record Loss from Meta: Mark Zuckerberg’s Costly Move

When Facebook rebranded to Meta in September 2021, CEO Mark Zuckerberg signaled a decisive shift from the Web2 social media landscape towards the metaverse.

Three years on, it’s crucial to examine the financial depth of the company’s commitment and how its ventures into virtual (VR) and augmented reality (AR) technologies are influencing Meta’s financial health, especially with the first-quarter earnings call scheduled for April 24.

What’s Happening at Meta?

In 2023, Meta reported revenues of $134.90 billion, marking an approximate 16% increase from the previous year. The company’s fourth-quarter revenue reached a record $40.1 billion, surpassing analyst expectations. This performance might suggest that Meta’s foray into the metaverse is paying off, yet the situation presents a complex picture that requires careful analysis ahead of the upcoming earnings call.

While the Facebook social media platform has shown strong performance, Meta’s Reality Labs—the division behind the Quest VR headset line—has recorded consecutive annual operating losses totaling about $40 billion since 2021. Consequently, the company’s financial gains have been primarily driven by its portfolio of social media and messaging applications, including Facebook, Instagram, Messenger, and WhatsApp.

Remarkable Details About the Process

According to UploadVR, Meta has sold nearly 20 million Quest headsets since March 2019. For context, Apple sold approximately 151 million iPhones in 2023 alone, and Sony has sold around 50 million PlayStation 5 consoles since its launch in 2020 as of December 2023.

The financial results for Meta’s Reality Labs, while showing significant investment losses, haven’t notably alarmed investors and shareholders. The Motley Fool highlighted that while Meta is aggressively investing in Reality Labs for research and development, it is concurrently buying back its own shares at an increased pace.

Since 2021, the company has repurchased $92 billion of its own stock and reportedly had a $31 billion fund earmarked for further purchases by the end of 2023. Additionally, in February, Meta set aside another $50 billion for more buybacks, indicating a strong financial strategy alongside its investment in the metaverse.

You may also like this content

- What Is the Multiverse?

- Similarities and Differences Between the Multiverse and the Metaverse

- Predictions for the Future of the Metaverse Concept

Follow us on TWITTER (X) and be instantly informed about the latest developments…