Bitcoin ETFs Surge in Trading Volume

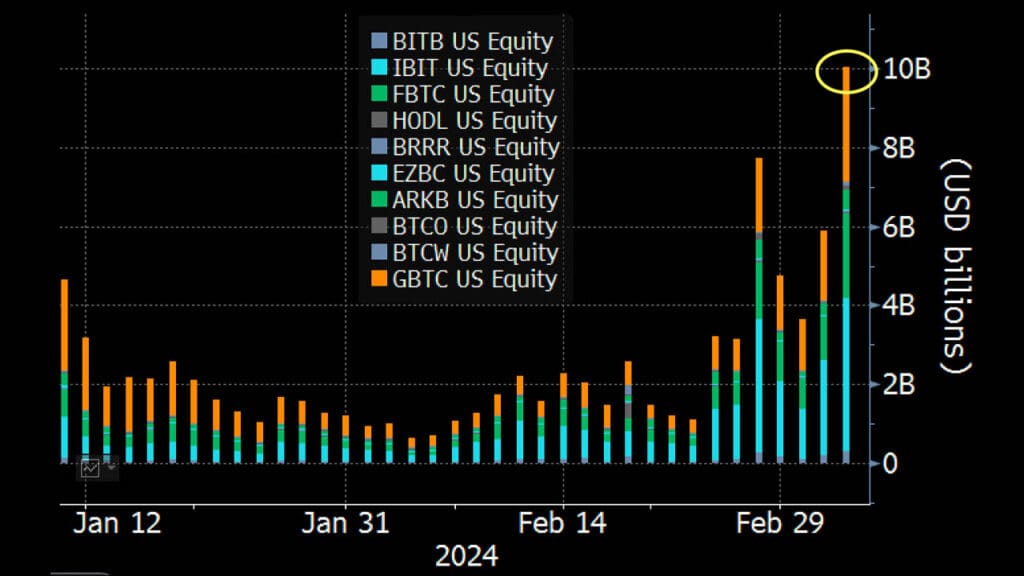

In line with the record-breaking price of Bitcoin (BTC), Bitcoin ETFs also achieved record trading volumes. Data from yesterday showed a trading volume of 10 billion dollars.

In a piece of news we shared with you yesterday, we discussed the movements in the cryptocurrency markets, noting that the price of Bitcoin (BTC) was on the verge of setting a new record. This prediction materialized within hours, with BTC climbing to $69,170. However, this rise was not sustained initially. Following its sharp increase, BTC underwent a significant correction, dropping to the $59,300 level. As of the time of writing, BTC is trading at $66,469.

Amid these developments, Bitcoin ETFs captured widespread attention. This is because the U.S. authorization of ETFs allowed investors to indirectly invest in Bitcoin. Recent updates indicate that record volume levels were reached on March 5.

A transaction volume of 10 billion dollars has been reached!

The data on Bitcoin ETFs reveals that on March 5, a trading volume of 10 billion dollars was achieved. The Bitcoin ETF named “IBIT” by BlackRock emerged as the most favored investment fund, with 3.8 billion dollars being transacted through IBIT alone.

The ongoing activity in the cryptocurrency markets is expected to continue driving significant volatility in Bitcoin ETFs. However, it’s important to understand that this does not guarantee a continuous upward trend. BTC may experience rapid increases and undergo sharp corrections within hours, just as it did the previous day. Consequently, this volatility could lead to significant fluctuations in altcoins along with BTC.

*This content should not be considered as investment advice.

You may also like this content

- AI Tools Are Coming to Opera Android: Here Are the Innovations

- Amazon Introduces Highly Ambitious Next-Generation AI Chip Trainium3

- OpenAI Is Losing the AI Race: “Emergency” Declared for ChatGPT

Follow us on TWITTER (X) and be instantly informed about the latest developments…