AGIX’s Decline Ahead of Unlock Event

The value of AGIX, the native cryptocurrency of the well-known artificial intelligence project SingularityNET, is persisting in its decline.

Crypto analyst Lockridge Okoth indicates that the trend suggests a continuing downward movement. This development is happening alongside the network’s impending token unlock event, which is set for later this week.

Approaching Token Unlock Event for AGIX

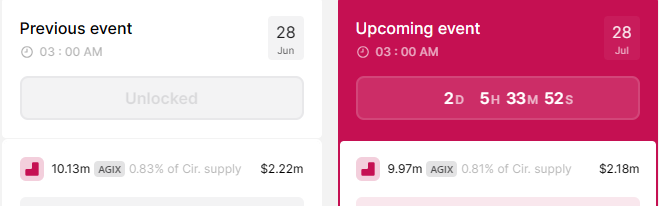

The SingularityNET ecosystem’s token, AGIX, has seen a significant decrease in its 24-hour trading volume by 55%. Moreover, its price has begun a downward trend, falling nearly 2% on the day before the highly anticipated unlock event. As Metaverseplanet.net reports, the unlock event for SingularityNET is scheduled for July 28. Token unlocking refers to the process where a certain number of tokens, usually held back by developers and early investors, are released into the cryptocurrency’s circulating supply.

This process, influenced by supply and demand principles, often leads to a price decline. Therefore, the unlocking of tokens prompts holders to attempt to capitalize on their investments before the release of the unlocked tokens, leading to market instability due to increased selling activities.

According to data from TokenUnlocks, approximately 9.97 million AGIX tokens, worth about $2.18 million, are expected to be introduced to the market. This event is anticipated to take place on July 28, just over two days from now. Notably, the tokens being released will account for 0.83% of SingularityNET’s total supply.

How Will Artificial Intelligence Reflect on the Coin’s Price?

As of now, AGIX is trading at $0.219, continuing its journey within a downward channel. Indicators of market momentum, such as the Relative Strength Index (RSI) and Awesome Oscillators (AO), are both showing a downward trend.

This indicates a decreasing momentum and the continuation of the bearish trend. As a result, the price of AGIX could see a further decline of 12% to reach the immediate support level at $0.192. This prediction is further supported by the 50- and 100-day Simple Moving Averages (SMA), which are indicating overselling at $0.233 and $0.268, respectively.

Conversely, should traders decide to buy more AGIX at its current price or to bolster their portfolios in anticipation of the unlock, it could push the AGIX price beyond the upper boundary of the technical pattern, thereby igniting an increase in buying momentum. Nonetheless, traders should look for a clear break above the $0.309 resistance level to confirm a bullish trend. Such an upward movement would signify a 40% increase from the current price.

You may also like this content

- Meta Building World’s Fastest AI Supercomputer for Metaverse

- Artificial Intelligence Will Make Decisions Instead Of People

- SingularityNET & Mandala: AI Metaverse

Follow us on TWITTER (X) and be instantly informed about the latest developments…