Prove Without Revealing: The Power of Zero-Knowledge Proofs

VIDEOS

Let’s face it, staring at static candlestick charts all day can make your eyes bleed, which is why I created this section to visualize the market’s heartbeat. I curate the most essential video content—from deep-dive documentaries to rapid-fire technical analysis—so you can watch, learn, and understand the complex mechanics of the blockchain revolution without getting lost in a sea of confusing numbers.

CRYPTO NEWS

The crypto market never sleeps, and frankly, neither do I. In this section, I filter out the endless FUD and clickbait to bring you the raw, market-moving signals that actually matter. Whether it’s a sudden Bitcoin rally, a regulatory crackdown, or the next big altcoin shift, I keep you plugged into the blockchain pulse so you’re never caught off guard when the charts turn green—or red.

CRYPTO BLOG

This isn’t just another news feed; it’s my personal ledger of the decentralized revolution. Here, I dig deeper than the daily price swings to explore the philosophy, the technology, and the massive cultural shift of Web3, sharing honest insights and battle-tested guides to help you navigate the wild frontier of digital ownership without getting wrecked.

CRYPTOCURRENCIES

To me, cryptocurrencies are more than just digital tickers scrolling across a screen; they are the first real challenge to a financial system that has been stagnant for decades. In this section, I strip away the banking jargon to look at the assets themselves—from the digital gold standard of Bitcoin to the programmable potential of Ethereum and the wild experiments of altcoins—helping you understand not just the price, but the revolutionary technology backing every single coin.

Featured Cryptocurrencies

Real-time market prices from the Metaverse

Loading Data...

CRYPTO GLOSSARY

I remember the first time I read a whitepaper and felt like I was trying to decipher an alien language, which is exactly why I built this Glossary. It serves as your ultimate translator in the confusing world of Web3, breaking down everything from slang like “HODL” and “WAGMI” to complex tech terms like “ZK-Rollups” into plain, human English so you can finally stop nodding along and actually understand what you’re investing in.

Explore Categories

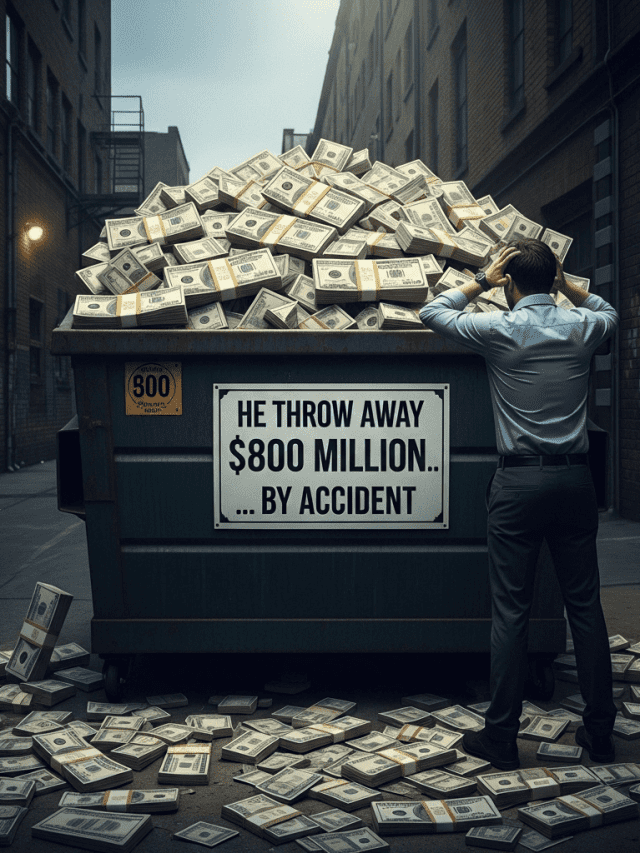

Crypto: The Wild West of Finance (And Why You Should Care)

Let’s address the elephant in the room: The crypto market is crazy. One minute Bitcoin is “dead,” and the next, major banks like JPMorgan are offering it to their clients. It’s volatile, it’s loud, and frankly, it can be terrifying. But it’s also the most significant financial revolution of our lifetime.

In this section of Metaverse Planet, I cut through the “to the moon” hype and the panic-selling fear. I’m not here to give you financial advice (I’m a tech enthusiast, not a banker); I’m here to give you clarity.

Whether I’m analyzing why institutional giants think Bitcoin is undervalued or explaining the technical difference between a Token and a Coin, my goal is to help you understand the technology behind the price tag. Because once you understand how the blockchain works, the price swings stop looking like chaos and start looking like opportunity.

Welcome to the future of money. Don’t lose your private keys.

Frequently Asked Questions (No Financial Advice, Just Truths)

Q1: Is crypto just gambling? Answer: If you buy a random “meme coin” just because a celebrity tweeted about it, yes, it’s gambling. But if you invest in projects with real utility, decentralized infrastructure, and solving real-world problems (like banking the unbanked), it’s investing in technology. I write these articles so you can tell the difference between a lottery ticket and a technological asset.

Q2: Why is the market so volatile? Answer: Because it’s young. As I mentioned in my “Bitcoin Bloodbath” analysis, crypto doesn’t have the 100-year stability of the stock market yet. Plus, it never sleeps—it trades 24/7 globally. This volatility is scary, but it’s also where the growth comes from.

Q3: Is it too late to get into Bitcoin? Answer: People asked me this when Bitcoin was $1,000, $10,000, and $50,000. My answer is always the same: We are still early. As you’ll see in the reports I cover from Coinbase and institutional investors, big money is just starting to enter the room. We haven’t even reached mass adoption yet.

Q4: How do I keep my crypto safe? Answer: Security is my #1 rule. I have entire guides on 2FA (Two-Factor Authentication) and avoiding scams. The golden rule? “Not your keys, not your coins.” If you leave your money on an exchange, you don’t really own it. Learn to use a personal wallet.

Q5: What is the difference between “Crypto” and “Web3”? Answer: Think of “Crypto” as the money and “Web3” as the internet built on top of it. Crypto is the asset (Bitcoin, Ethereum), while Web3 is what we do with it (Identity, Ownership, Metaverse). This category focuses on the financial assets and the market movements.