Meta Shareholder Urges Reduction in Metaverse Investments

Brad Gerstner, the CEO of Altimeter, a significant investor in Meta, penned an open letter to Mark Zuckerberg regarding the current state of Meta.

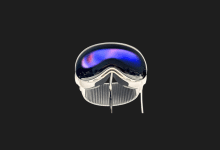

In this letter, Gerstner suggested that Meta should consider reducing its investment in the Metaverse Reality Lab projects.

This communication reflects an investor’s perspective on the strategic direction and resource allocation within Meta, particularly concerning its ambitious Metaverse initiatives.

Meta Investors Are Annoyed By Metaverse!

Brad Gerstner, CEO and President of Altimeter Capital, penned an extensive open letter in October, highlighting several shortcomings that Meta had encountered in recent years. In this letter, he also outlined a strategy for the company to regain its former strength.

Gerstner emphasized that “Meta needs to rebuild trust with investors, employees, and the tech community in order to attract, inspire, and retain the best talent globally. In summary, Meta needs to adapt and focus.”

The letter reflects growing concerns among Meta investors and shareholders about the company’s recent performance and its future prospects if a change in direction isn’t implemented promptly. Notably, Meta’s shares plummeted over 61 percent in 2022, signaling troubling times for its investors and shareholders.

Gerstner proposed a three-phase plan aimed at helping the tech giant rebound and solidify its market position. He suggested that this plan could potentially double the company’s revenue to $40 billion annually, focusing on optimizing teams and investments. The plan’s first phase involves reducing personnel expenses by 20 percent, translating to a direct cut in the workforce and associated costs.

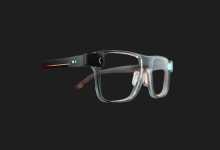

The second phase calls for a reduction in annual CAPEX from $30 billion to $25 billion, implying a minimum cut of $5 billion. The third and final phase suggests that attempts at building the Metaverse should be scaled back, with investments in Reality Labs capped at no more than $5 billion per year.

Letter Recommends Hard Decisions!

Brad Gerstner, CEO and President of Altimeter Capital, penned an extensive open letter in October, highlighting several shortcomings that Meta had encountered in recent years. In this letter, he also outlined a strategy for the company to regain its former strength.

Gerstner emphasized that “Meta needs to rebuild trust with investors, employees, and the tech community in order to attract, inspire, and retain the best talent globally. In summary, Meta needs to adapt and focus.”

The letter reflects growing concerns among Meta investors and shareholders about the company’s recent performance and its future prospects if a change in direction isn’t implemented promptly. Notably, Meta’s shares plummeted over 61 percent in 2022, signaling troubling times for its investors and shareholders.

Gerstner proposed a three-phase plan aimed at helping the tech giant rebound and solidify its market position. He suggested that this plan could potentially double the company’s revenue to $40 billion annually, focusing on optimizing teams and investments.

The plan’s first phase involves reducing personnel expenses by 20 percent, translating to a direct cut in the workforce and associated costs. The second phase calls for a reduction in annual CAPEX from $30 billion to $25 billion, implying a minimum cut of $5 billion.

The third and final phase suggests that attempts at building the Metaverse should be scaled back, with investments in Reality Labs capped at no more than $5 billion per year.

You may also like this content

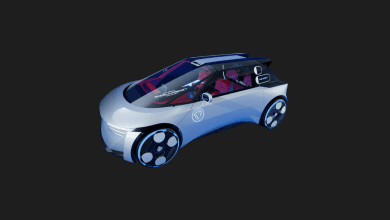

- The Metaverse: What it is, How to Enter, and Its Potential Impact

- Metaverse 5 Reasons Why its Awesome

- Metaverse Coins Buying Guide

Follow us on TWITTER (X) and be instantly informed about the latest developments…