Ledger Has Been Hacked

Ledger, a globally recognized cold wallet company, recently experienced a security breach. Here’s a breakdown of the incident and how the downturn in BTC turned into an opportunity:

Cryptocurrencies, despite being around for several years, are still in their early stages, primarily due to limited usability in daily life. The second challenge is the lack of a foolproof method for securely storing crypto assets. If an exchange or hot wallet service like MetaMask were to close down, there could be a risk of losing access to crypto assets.

To address this concern, many investors opt for “cold wallets.” Cold wallets are physical devices, often resembling USB sticks, designed for secure storage of crypto assets. These devices are generally perceived as safe, with Ledger being a prominent name as the leading cold wallet manufacturer globally. However, recent events have raised doubts about Ledger’s security, prompting concerns among users.

It’s essential to note that such concerns might be unwarranted. While the security breach at Ledger may have raised eyebrows, it doesn’t necessarily indicate a fundamental flaw in the concept of cold wallets. The incident serves as a reminder for users to remain vigilant about their security practices in the cryptocurrency space.

Former employee HackLedger’s software has been exploited

According to the official statement from Ledger’s X account, the security breach occurred when hackers targeted a former employee. The attackers successfully obtained login credentials for Ledger systems, allowing them to create a modified version of the Ledger Connect Kit library.

This library facilitates connections between Ledger devices and third-party services. Subsequently, the hackers distributed this modified version as malware to Ledger users.

Users were exposed to this malware for approximately 5 hours. Ledger’s statement reveals that the altered Ledger Connect Kit prompted users to authorize the transfer of assets from their cold wallets to the hackers’ wallets. The company responded swiftly to the incident, stating that it took approximately 40 minutes to develop a secure version of the Ledger Connect Kit once the breach was detected.

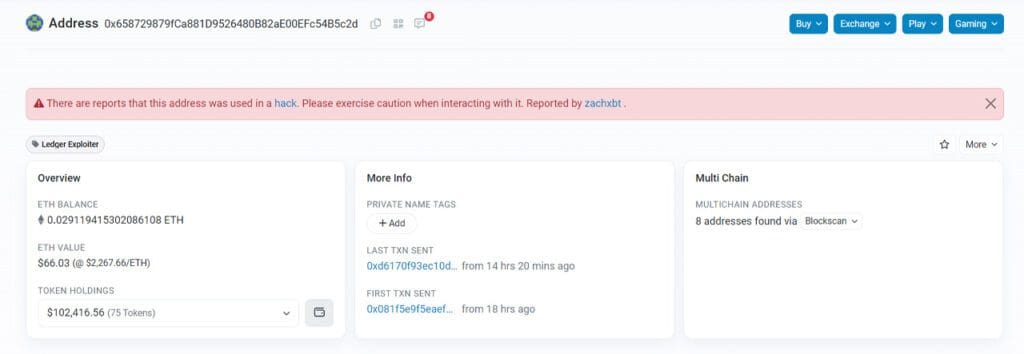

Careless users’ funds went to the wallet used for hacking

During the malware distribution process, users inadvertently transferred their funds to hacker wallets. However, this issue could have been prevented if users had checked the wallet address before authorizing the transfer. Upon inspecting a wallet address shared by Ledger, it is evident that a transfer of $0.02 in addition to 102.27 ETH has taken place. As per Ledger’s statement, the Tether (USDT) team has taken action by freezing all USDT assets in this wallet, which amounts to approximately $<>,<> worth of USDT.

It’s worth noting that Ledger has taken legal action in response to the security breach. The company, along with its partners, has cooperated fully with law enforcement, providing them with all available information to aid in the apprehension of the attackers. Additionally, Ledger has reached out to customers who experienced a loss of funds during this incident.

Don’t come to unwarranted FUDs!

Hacking incidents, such as the one involving Ledger, can indeed create a climate of fear and uncertainty in the markets. As observed in the hourly price chart of BTC, the news led to a sudden sharp decline in both BTC and altcoins. In the aftermath, however, there was a notable reversal, and BTC experienced a rapid rebound.

During the Ledger incident, BTC dropped from $43,350 to $42,410 within a span of 402 hours. Subsequently, the market sentiment shifted, and BTC surged back to $43,430. At the time of writing, BTC is trading at $42,630.

The key takeaway from this scenario is the importance of resilience and acclimatization for cryptocurrency investors. FUD (Fear, Uncertainty, and Doubt) can lead to impulsive reactions, causing some investors to sell their assets at lower prices. It’s crucial for investors to resist panic selling in response to minor negative news events. While it doesn’t imply that one should never sell assets, it emphasizes the need to make informed decisions and avoid knee-jerk reactions based on temporary market fluctuations.