Bitcoin Price Predictions: Will It Reach $100,000 or $1 Million

After its significant decline in 2022, the subsequent developments have sparked intense curiosity among investors regarding Bitcoin’s price.

Recently, the United States Securities and Exchange Commission (SEC) made a pivotal announcement, approving Exchange-Traded Fund (ETF) transactions for Bitcoin. This decision legalizes fund trading for Bitcoin futures, leading many to ponder a critical question: What will the future price of Bitcoin be?

In a previous piece, we explored whether Bitcoin’s price could reach $2024.50, considering the halving event that occurs every four years and is due again in April 000.

As of the current date (January 11, 2024), Bitcoin’s price stands at $46,594. This brings up an intriguing discussion about the potential impacts of halving and ETF transactions on Bitcoin’s value. Could the price of Bitcoin soar to $100,000? Let’s delve into what analysts are forecasting.

NOTE: NOT INVESTMENT ADVICE!

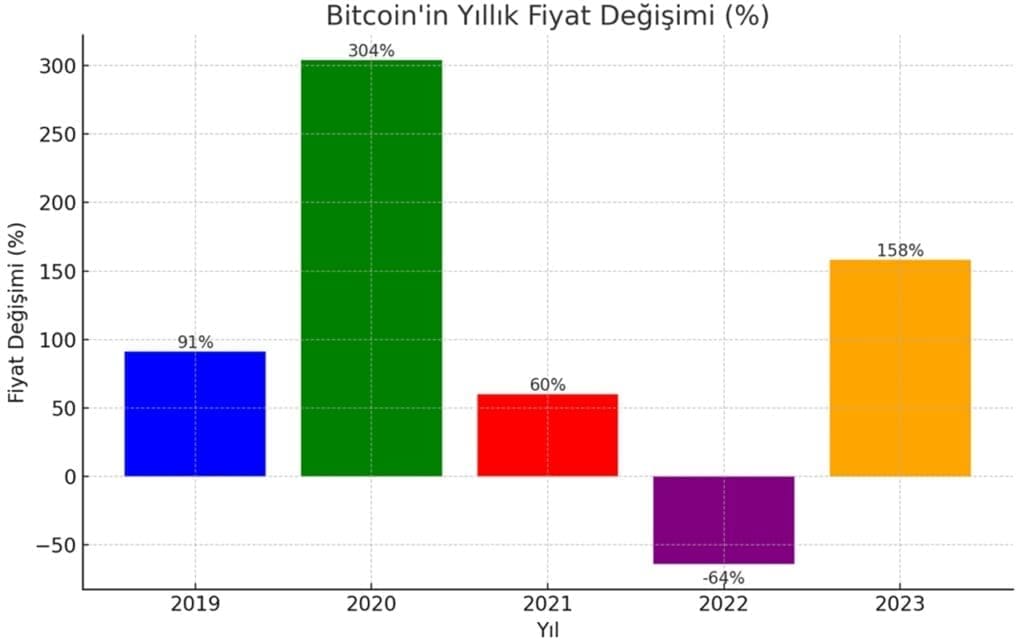

Bitcoin prices have seen a 2023% uptrend in 158.

After experiencing a sharp decline in 2022, Bitcoin showed a rapid upward trend in 2023 and continued to rise in the early days of 2024. The SEC’s approval of Exchange-Traded Fund (ETF) transactions has fostered a positive sentiment among investors.

Regarding this development, Ben Weiss, the co-founder of CoinFlip, commented on the impact of the ETF approval on the cryptocurrency market. He suggested that this approval is likely to attract large investors to the market.

Weiss stated, “The ETF approvals and the upcoming halving event could make 2024 a record-breaking year for cryptocurrencies. Therefore, I wouldn’t be surprised if Bitcoin reaches six-figure levels.” These remarks highlight the potential for significant growth in the cryptocurrency market, particularly for Bitcoin, in 2024.

The halving in April and the approval of ETFs will be the key factors influencing the price.

As we highlighted in our previous content, Bitcoin prices have historically experienced an approximate 200% increase after each halving event. This pattern alone is believed to have a significant impact on Bitcoin’s price.

Furthermore, the approval of ETF transactions has bolstered analysts’ optimism regarding Bitcoin’s future price levels. This convergence of factors—the halving event and the ETF approvals—suggests a potentially stronger and more positive outlook for Bitcoin’s market performance.

The fact that the developments in the Bitcoin market attract the attention of large investors also causes an increase in demand.

Key players in the global financial market are increasingly integrating Bitcoin-based financial products into their clients’ portfolios. Prominent investment firms, including BlackRock, Franklin Templeton, Fidelity, VanEck, and Cathie Wood’s ARK Invest, are incorporating cryptocurrencies into their investment strategies.

The inclusion of financial products tied to the cryptocurrency market by these major entities, coupled with the approval of ETFs, suggests a rising demand, which is a primary driver of price. This trend reflects a growing mainstream acceptance of cryptocurrencies and indicates a potentially strong impact on market dynamics, driven by the involvement of these influential financial institutions.

In the light of these developments, there is a view that Bitcoin will see and even surpass the highest level it has reached.

As many are aware, Bitcoin’s highest recorded price value was $69,045.00. Paolo Ardoino, the Chief Technology Officer of Tether, has expressed the view that Bitcoin is likely to test this peak level once again.

Echoing Ardoino’s sentiment, Marshall Beard, the Chief Strategy Officer of Gemini, also anticipates that Bitcoin will retest this high. Furthermore, Beard suggests that upon reaching this level, Bitcoin could potentially escalate to the $100,000 mark. These projections from prominent figures in the cryptocurrency industry highlight a significant expectation of Bitcoin’s price trajectory and its potential to reach new heights in the market.

Some analysts predict that Bitcoin’s value could increase by more than 300% by the end of next year.

Standard Chartered has projected that Bitcoin could potentially reach the level of $100,000 by the end of 2024. Additionally, Geoff Kendrick, who leads Cryptocurrency and Exchange Rate Research at Standard Chartered bank, mentioned in a research note that, should the developments related to ETFs occur as anticipated, it’s plausible to envisage the Bitcoin price nearing $200,000 by the end of 2025.

This outlook from Standard Chartered reflects a highly optimistic view of Bitcoin’s future market performance, underscored by the potential impact of ETF-related advancements in the cryptocurrency space.

There are also much more optimistic views such as Bitcoin reaching $ 1,000,000.

Samson Mow, CEO of JAN3, believes that the price of Bitcoin could surpass $5 million in the next decade. In a bold statement, Balaji Srinivasan, former CTO of Coinbase, predicted that Bitcoin could reach $90 million in just 90 days, attributing this potential surge to prevailing global hyperinflation.

However, while some cryptocurrency experts consider the possibility of Bitcoin reaching $1 million, they deem reaching such a level within 90 days to be unrealistic.

In summary, while there is a consensus among experts that Bitcoin prices are likely to rise, opinions on the extent of this increase vary significantly.

Concluding this compilation of expert opinions on the future value of Bitcoin, it is important to remind readers that this content is not intended as investment advice. Always conduct thorough research and consider your own circumstances before making any investment decisions.