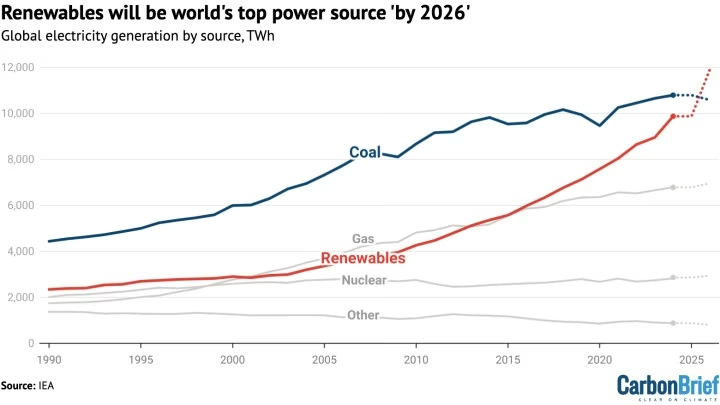

Renewable Energy Will Surpass Coal in 2026

According to the IEA, leadership in global electricity generation will shift from coal to renewable sources by 2025 or 2026. In the same period, nuclear production is also preparing to break records.

The International Energy Agency (IEA) announced that global electricity demand will increase by an average of more than 3 percent annually until 2026. Emerging economies in Asia, and expansion in industry, transportation, and data center usage are triggering this growth. The majority of the demand will be met by renewable energy, natural gas, and nuclear sources.

According to the IEA‘s mid-year update report, electricity consumption will increase by 3.3% in 2025 and 3.7% in 2026. This rate significantly surpasses the 2.6% average of the 2015-2023 period. Although the growth rate dips slightly compared to the 4.4% increase in 2024, one of the strongest trends of the last decade continues.

Renewables Are Surpassing Coal The report predicts that renewable sources will surpass coal for the first time by 2025 or 2026, becoming the world’s largest electricity generation source. In the same period, nuclear energy production is expected to reach record levels. The reactivation of power plants in Japan, strong production performance in the US and France, and new projects in Asia will be influential in this increase. Additionally, natural gas power plants are increasingly substituting coal and oil usage. With this transformation, carbon emissions from electricity generation are expected to remain flat in 2025 and show a slight decline in 2026.

60% of the global demand increase will come from developing economies in Asia. China‘s electricity consumption will rise by 5.7% in 2026, and India‘s by 6.6%. The growth of data centers in the US will ensure demand remains above 2% annually until 2026. In the European Union, while electricity demand increases by approximately 1% in 2025, it is expected to accelerate further in 2026.

Prices Increased, Competition Unbalanced In the first half of 2025, wholesale electricity prices in the European Union and the US increased by 30% to 40% compared to last year. The main reason is tightening natural gas markets. Although prices remain below the 2023 average, they still hover well above 2019. Furthermore, increasingly frequent negative wholesale prices reveal an urgent need for investments in grid flexibility, energy storage, and flexible consumption. Industrial competition shows serious differences between regions. In Europe, electricity prices for energy-intensive sectors are at double the level of the US and are quite high compared to China.