35 Basic Concepts for First-Time Cryptocurrency Entrants

If you’re thinking about diving into the bustling world of cryptocurrency, getting to grips with a few basic principles is crucial. Cryptocurrencies have ignited a revolution in the financial sector, gaining attention for their ability to innovate traditional finance and providing investment opportunities for portfolio diversification.

Considering the high-risk and volatile nature of these markets, it’s imperative for both existing investors and those pondering over diving into cryptocurrency investments to grasp some essential concepts. This knowledge is key to successfully navigating the complexities of this rapidly evolving financial arena.

Let’s start with the person behind the crypto revolution: Satoshi Nakamoto

The true identity of the individual known as the creator of Bitcoin, who has undeniably revolutionized the financial world, remains a mystery even today.

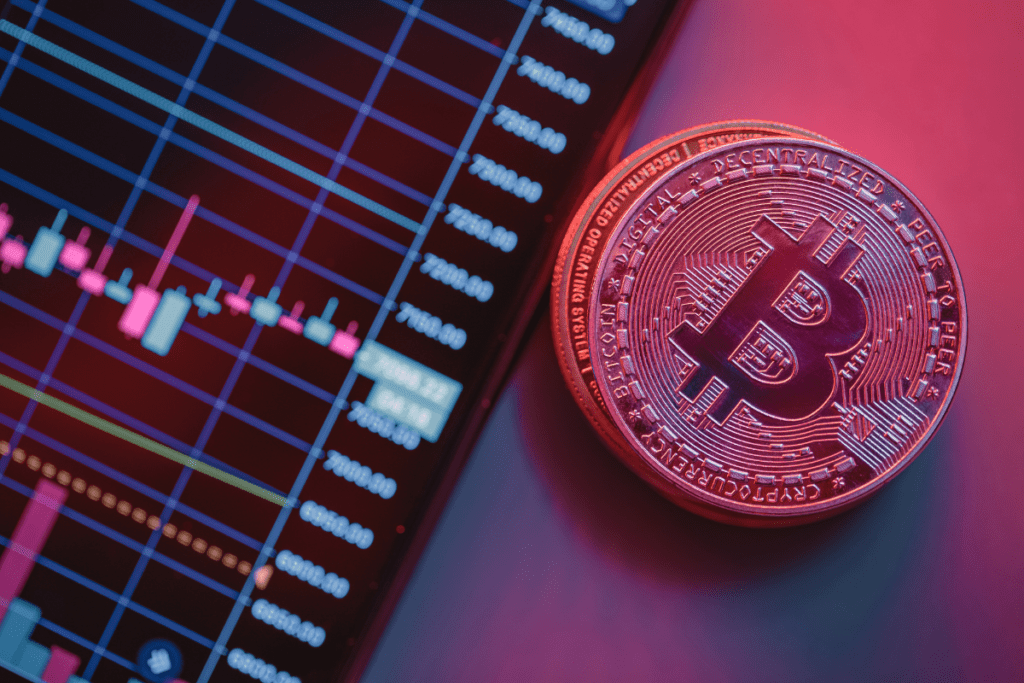

Cryptocurrency:This refers to a form of virtual currency technology that operates using blockchain technology and lacks a physical manifestation.

Blockchain: This technology is essentially a decentralized ledger that chronicles all transactions as blocks linked together. Utilizing distributed ledger technology, the blockchain records transactions in an immutable manner. This transparency and permanence of recorded data eliminate the need for a central authority, allowing for open access to information.

“Bitcoin” is the first cryptocurrency that emerged in 2009.

Altcoin: This term, short for “alternative coin,” refers to cryptocurrencies that are distinct from Bitcoin.

Stablecoin: A type of cryptocurrency designed to minimize price volatility. Its value is typically pegged to a more stable asset, such as the US dollar, to maintain consistency.

Shitcoin: A colloquial term for crypto assets that are considered to have little to no practical use, low market value, and a high risk of failure.

Memecoin: These are a subset of cryptocurrencies that are primarily created for humorous purposes and typically lack intrinsic value or practical purpose.

Token: Tokens are a type of cryptocurrency that do not possess their own blockchain network. Instead, they are developed using the blockchain infrastructure of other cryptocurrencies.

NFT: Standing for “non-fungible tokens,” these digital assets are unique and cannot be exchanged on a one-to-one basis with other tokens, due to their individualized characteristics.

“Mining”, on the other hand, is a kind of cryptocurrency earning.

Mining: This process involves confirming transactions on a blockchain network by solving complex mathematical problems. Participants in this network, known as “miners,” are often rewarded with a specific amount of cryptocurrency for each transaction they validate.

Staking: This refers to the act of locking cryptocurrencies for a set period to support a particular cryptocurrency network. Investors who stake their cryptocurrencies are typically rewarded with additional cryptocurrency over time.

Airdrop: In the context of blockchain-based projects, an airdrop is the distribution of free cryptocurrency to the community or token holders.

Initial Coin Offering (ICO): An ICO, which stands for “initial coin offering,” is the inaugural release of a new cryptocurrency, typically aimed at raising funds for a blockchain-based project.

There are two types of wallets where you can store your crypto assets: “hot wallets” and “cold wallets”.

Cold Wallet: Cold wallets, essentially resembling USB sticks, facilitate the offline storage of cryptocurrency assets. This method of storage is highly recommended for its security benefits, particularly for its protection against hacking risks.

Hot Wallet: This is a kind of cryptocurrency wallet that is accessible online, offering ease of access and transaction capabilities over the internet.

At the beginning of the concepts for the movements in the markets are the concepts of “bear” and “bull”.

Bear Market: This term refers to a market characterized by declining prices.

Bull Market: This term is used to describe a market where prices are on an upward trajectory.

Pumping: This refers to a sharp increase in the price of assets, typically marked by a rapid uptrend.

Dump: This denotes a sharp decrease in the price of assets, characterized by a significant downturn.

Cryptocurrency exchanges, on the other hand, are digital platforms that allow investors to buy and sell.

Unlike traditional stock exchanges, cryptocurrency exchanges exclusively facilitate the trading of crypto assets. These exchanges support various types of transactions, as outlined below:

Order: This term generally refers to the buy or sell instructions placed for trading on exchanges.

Limit Order: This is a type of order where the investor sets a maximum and minimum price for executing buy and sell orders when trading a crypto asset.

Derivatives: These are transactions typically conducted between two parties, based on the investor’s prediction of the future value of an asset’s price. It’s important to note that while derivatives can offer high returns, they also carry significant risks, especially when used purely for speculative purposes without grounding in technical or fundamental analysis.

To ensure the security of your account and information, it is useful to know these concepts:

Two-factor Authentication (2FA): This security method requires two different components to verify a user’s identity. Typically, this involves a password and a second factor like SMS 2FA or Google Authenticator.

Anti-Phishing Codes: These are specially created codes used to prevent phishing, a type of fraud where attackers trick users into revealing sensitive information like passwords. These codes help assure that the emails you receive are genuinely from the intended organization. If an incoming email contains your unique code, it’s a reliable sign of authenticity.

Whitelist: This security feature, applicable in both exchanges and personal cryptocurrency wallets, restricts withdrawals to pre-approved accounts. It often requires two-factor authentication to be deactivated, adding an extra layer of security.

These frequently used concepts are the jargon of cryptocurrency investors.

ATH: Standing for “all-time high,” this term signifies the highest price level that a cryptocurrency has ever reached in its history.

BTD: Short for “buy the dip,” this phrase suggests purchasing a cryptocurrency when its price has significantly dropped, aiming for a bargain.

DYOR: An acronym for “Do Your Own Research,” this term emphasizes the importance of conducting personal research before making investment decisions.

To the Moon: This phrase, indicating a strong belief that a cryptocurrency’s price will rise significantly, is often used in enthusiastic contexts.

Whale: In the cryptocurrency world, a “whale” refers to an investor who holds a substantial amount of crypto assets.

Fear of Missing Out (FOMO): This term describes a scenario where investors make impulsive trades based on the actions of others, often without logical or analytical basis, due to the fear of missing out on potential gains.

FUD: An acronym for “Fear, Uncertainty, and Doubt,” this term refers to the spreading of information that can cause investor anxiety and often leads to falling market prices due to panic selling.

HODL: Originally a typographical error for “hold” in a forum post, “HODL” has become a popular term among cryptocurrency investors, symbolizing a strategy of holding onto assets regardless of market volatility.