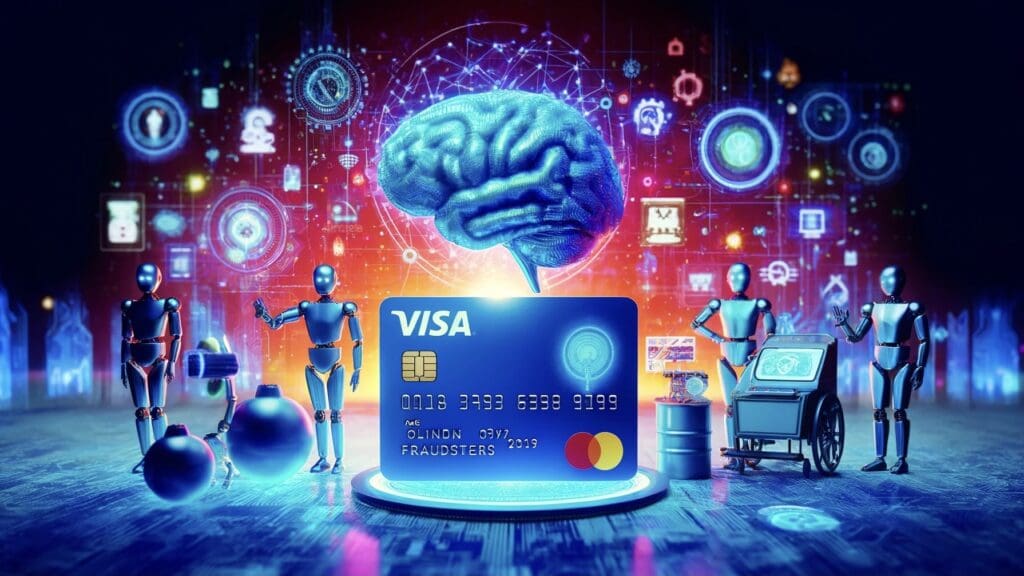

Visa Combats Scammers with AI Technology

Visa is taking a significant step in the fight against fraud by utilizing new artificial intelligence technology to analyze financial transactions.

As increasingly powerful AI tools become accessible to cybercriminals, issues like identity theft and fraud are on the rise. However, the good news is that these tools are also available to financial institutions and cybersecurity firms. Visa is leveraging artificial intelligence to enhance its fraud prevention measures.

Visa launches a new fight against fraudsters with artificial intelligence

Visa is employing a technology similar to that used to optimize CVs, create realistic images, and compose creative poems with artificial intelligence chatbots. However, this tool is specifically trained to analyze financial transactions, rather than books, articles, and social media posts, to understand the usage of words.

A confirmed transaction signifies valid account information, which can then be sold on the dark web or used for unauthorized purchases. Attacks on Visa’s network have reportedly resulted in more than $1 billion in losses over the past year, making this type of fraud one of the most prevalent.

Since 2019, Visa has been using a system called Visa Account Attack Intelligence (VAAI). Recently, it has introduced a scoring system known as VAAI Score, which instantly assigns a risk score to each transaction to better assess the likelihood of attacks.

The VAAI Score helps card service providers make informed decisions about blocking transactions, thus preventing valid purchases by legitimate cardholders from being incorrectly rejected as a precautionary measure. Initially, the VAAI Score is available to card service providers in the U.S.

Trained on more than 15 billion Visa transactions, the VAAI Score learns to distinguish between normal and abnormal transaction patterns and evaluates previous spending habits to determine the risk score for each online transaction. These AI-based tools from Visa represent a significant advancement in cybersecurity and finance.

However, it is not yet clear what new methods AI-powered security tools will introduce to combat fraud in the future. What impact will such technologies have on consumer security and privacy? Feel free to share your thoughts in the comments section below.