Bitcoin’s Future Growth Foreseen by Leading Investment Management Fund

Bitwise, an asset management firm, has released its forecast for Bitcoin, noting that the cryptocurrency’s potential is remarkably high, particularly influenced by ETFs.

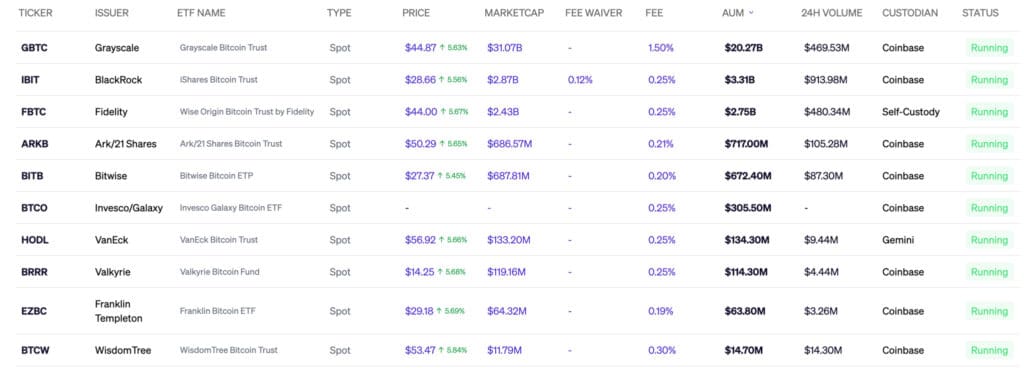

Earlier this month, 11 apps received approval to incorporate Bitcoin (BTC) into their ETF offerings. This led to a temporary surge in the leading cryptocurrency, which, after retreating from the $49,000 mark, has once again started to climb due to sustained demand, surpassing the $50,000 threshold yesterday for the first time in two years. Bitwise suggests that this upward trend is just the beginning.

Demand has far exceeded forecasts

ETFs (Exchange Traded Funds) enable the use of cryptocurrencies for investing in various assets beyond their own valuations. The total amount evaluated in this manner reached $28.35 billion, boosting the market volume to $39.8 billion. The trading volume over the last 24 hours amounted to $1.38 billion.

Matt Hougan, Chief Investment Officer at Bitwise Asset Management, which manages the fourth-largest Bitcoin ETF fund, remarked, “The sustained inflow and volumes are higher than I anticipated. The fact that we saw strong positive inflows on 18 of the first 19 days, not just on the first day, is truly satisfying. It makes me extremely optimistic about the future price trajectory of Bitcoin and its significance globally.”

Hougan also anticipates that demand will continue to grow as Bitcoin funds become accessible on more platforms. He notes that platforms managing billions of dollars are currently in discussions. In the upcoming month, he expects Bitcoin ETFs to represent the “largest ETF offering ever.” He further believes that growth in this sector will persist over the next 18 months.