Bitcoin and Stocks: Weakening Relationship

In a departure from previous trends, Bitcoin’s movement now contrasts with that of technology company stocks.

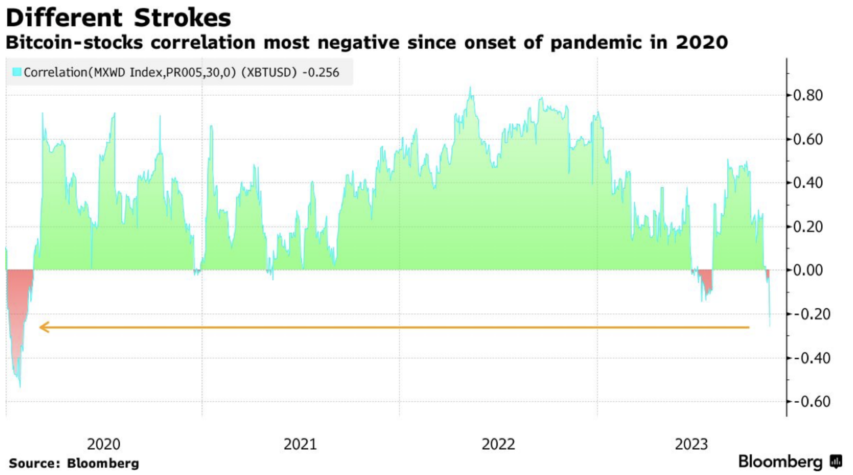

According to data from Bloomberg analysts, the correlation between Bitcoin and stocks has reached its most negative level since the onset of the pandemic.

During the late summer period, cryptocurrencies, which had previously shown little deviation, began moving in the opposite direction, particularly following the release of U.S. inflation data yesterday.

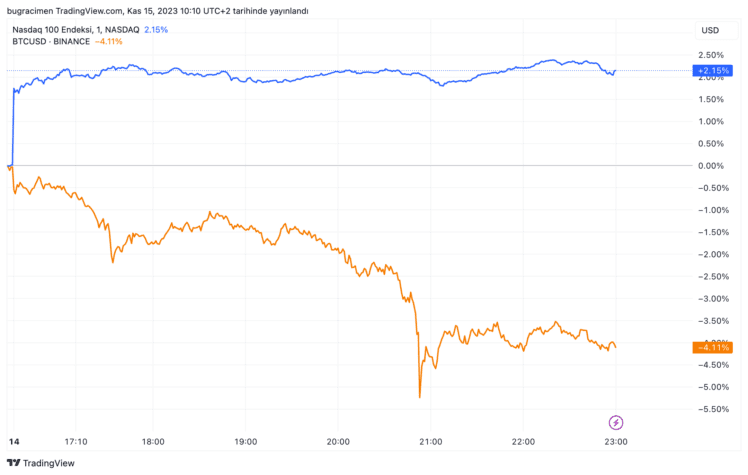

While the tech-heavy Nasdaq index surged by 2.15% in the last session, Bitcoin experienced a decline of 4.11% during the same period.

Period of negative correlation

As per Bloomberg data, the 30-day correlation rate between Bitcoin and the MSCI global stock index has dropped to -0.23 as of today.

Experts attribute this trend to recent developments in the crypto market. While the stock market remained relatively stable last week, the announcement of a spot ETF from the U.S. triggered a surge in Bitcoin and altcoins. However, the diminishing enthusiasm may now be prompting profit-taking in cryptocurrencies.