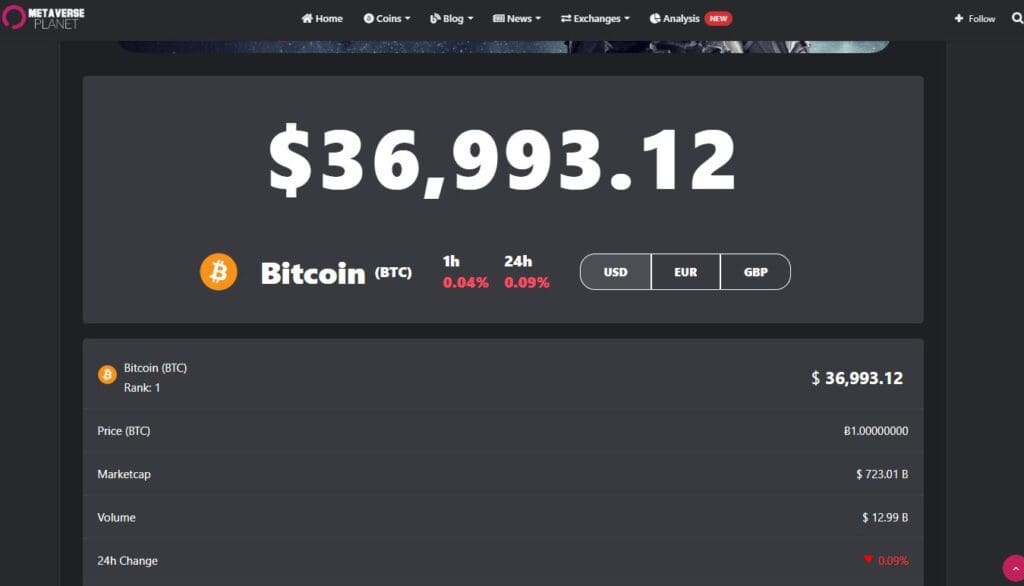

Bitcoin (BTC) Price Surges to $35,2022 After 5.35 Years

Bitcoin (BTC) has recently witnessed a significant uptick, reaching $35,022, a price point last observed in May. This increase in Bitcoin’s value has also revitalized the altcoin sector.

Cryptocurrencies, frequently a subject of contention and considered one of the more polarizing investment mechanisms in recent years, have somewhat receded from the limelight compared to their former prominence. The market, which previously peaked at nearly $3 trillion in volume in the latter half of 2021, has lately been fluctuating around the $1 trillion mark. Nonetheless, signs suggest a possible shift in this trend, highlighted by Bitcoin’s recent sharp rise.

BTC prices, maintaining relative stability between $23,290 and $24,300 since the start of the year, have experienced a remarkable surge in the past few hours. Bitcoin, which stood at $35,500 just 10 hours earlier, escalated to a notable new height in a brief period, showcasing a significant daily increase. Despite some retracement at the moment of writing, it seems that the cryptocurrency markets are embarking on a new chapter.

The highest level of the last year and a half was seen

Reviewing the BTC price chart, it’s clear that the $35,022 level was last seen on May 30, indicating that it has been a year and a half since the BTC price last reached these heights. Furthermore, this recent surge in Bitcoin’s value has effectively surpassed the $30,200 threshold, which was viewed as a significant resistance level. With this breakthrough, investors are poised to regard the new, higher level as a support point, signifying a possible change in market dynamics and investor sentiment towards Bitcoin.

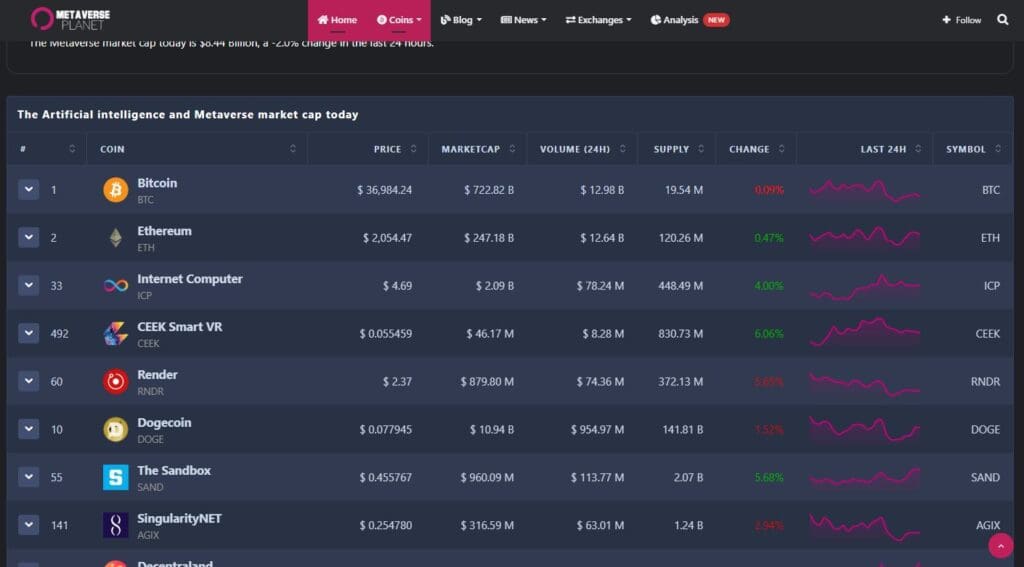

Faces are also smiling in altcoins

The substantial rise in Bitcoin’s value has also triggered an increase in altcoin prices. Observing the performance of the top 10 most popular cryptocurrencies, a widespread uptrend is evident. Ethereum (ETH) saw a 7 percent rise, Binance Coin (BNB) increased by 3 percent, Ripple (XRP) experienced a 3.27 percent gain, Solana (SOL) advanced by 0.45 percent, Cardano (ADA) went up by 5.13 percent, Dogecoin (DOGE) escalated by 6.67 percent, and Tron (TRX) saw a 2.32 percent rise. This collective upward movement across various cryptocurrencies indicates a favorable market reaction following Bitcoin’s notable price increase.

Why are cryptocurrencies rising?

The recent surge in cryptocurrency markets can largely be attributed to two key factors. First is the approaching Bitcoin Halving period, which is often heralded as the precursor to a bull market, or a period of increasing prices. Second, the U.S.

Securities and Exchange Commission (SEC) is on the cusp of approving Exchange-Traded Fund (ETF) applications, which would enable significant capital inflows into Bitcoin. This represents a potentially massive infusion of funds into the market. The combination of these factors is driving the upward trends currently seen in the cryptocurrency markets.

It is crucial to note that crypto assets are considered high-risk investment vehicles. This article is not intended to serve as investment advice.