In the cryptocurrency sector, the Bitcoin Fear Index plays a pivotal role by shedding light on consumer sentiment.

The Fear & Greed Index serves as a tool for investors and traders to assess the mood of the Bitcoin and wider crypto market from a sentiment perspective. It measures the extent of excessive fear or greed in the market, thus being aptly named the Fear and Greed Index.

Typically, when the market is in a state of extreme fear, it indicates that Bitcoin might be undervalued or priced lower, suggesting a potentially advantageous buying opportunity.

What does the Bitcoin fear index mean?

On the flip side, when the Fear and Greed Index shows extreme greed among market participants, it may indicate that Bitcoin’s price is much higher than its actual value, possibly presenting a good time to sell.

Grasping the nuances of such indices allows astute investors to purchase when the market is dominated by fear and sell during periods of greed, thus potentially improving their investment strategies.

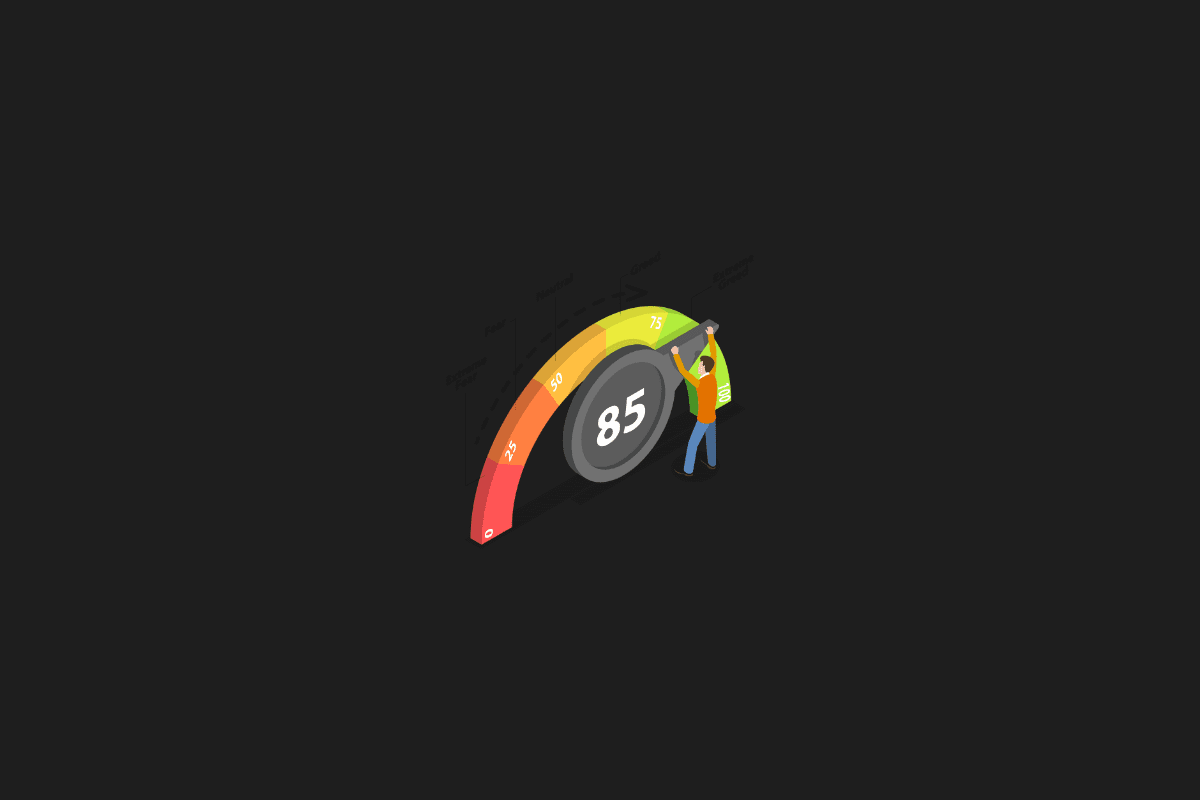

The index uses red to denote ‘extreme fear’ amid highly negative market sentiment, while green and ‘extreme greed’ reflect periods of positive sentiment and strong market momentum.

Therefore, the Fear and Greed Index acts as an essential instrument for emotion management in investing. It aids investors in separating their personal feelings from the broader market sentiment, helping to prevent knee-jerk reactions to abrupt price shifts and market fluctuations. This tool is especially useful when combined with other analytical tools that integrate various market data points.

The Fear and Greed Index operates on a straightforward scale from 0 to 100, employing a color scheme where 0 is represented by red and 100 by green. A score near zero in red denotes extreme fear, indicating a pervasive sentiment of concern among Bitcoin and cryptocurrency investors about potential further price drops.

On the other hand, a score near 100 in green reflects extreme greed, signaling that investors are highly optimistic regarding future price gains. The data for the Fear and Greed Index is aggregated daily from a variety of sources.